Vendor Payment Automation Solutions

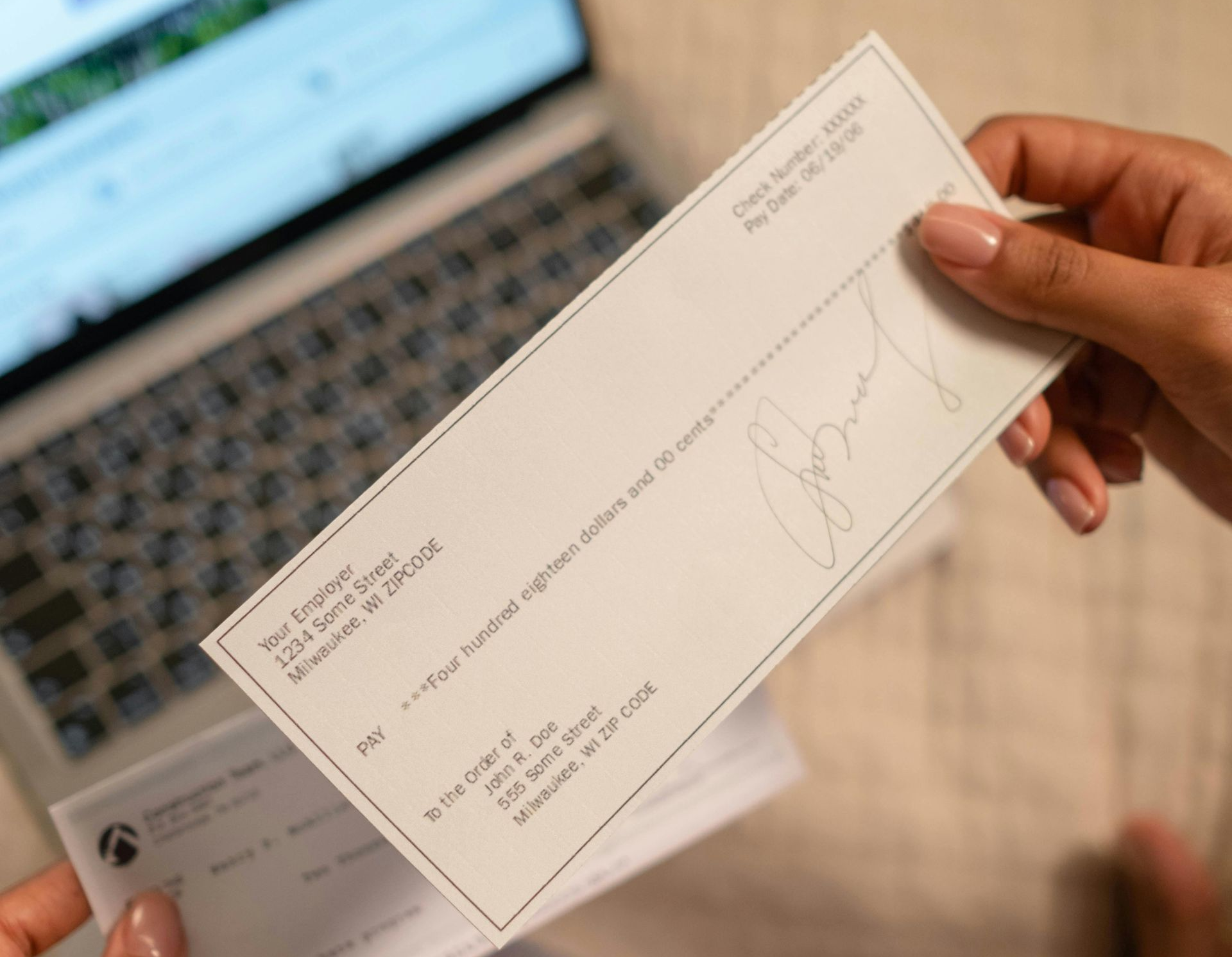

Stop printing checks, simplify vendor payments, reduce errors, and improve cash flow with Vendor Payment automation.

Managing vendor payments doesn’t have to be time-consuming or error-prone. Vendor Payment Automation streamlines the entire payment cycle—from invoice approval to final settlement—helping finance teams save time, cut costs, and strengthen vendor relationships.

- Flexible payment options – ACH, card, wire, or check, all from one platform.

- Smart approval workflows – route payments for approval based on rules and policies.

- Fraud prevention and compliance – encrypted transactions and audit trails.

- Payment status tracking – visibility for both finance teams and vendors.

- Pay vendors faster and more securely.

- Improve working capital with better cash flow forecasting.

- Reduce operational costs by eliminating manual work.

- Strengthen supplier trust and negotiate better terms.

Protect Payments. Reduce the Risk of Fraud. Protect Your Cash.

With payment automation, businesses can:

- Schedule payments automatically after invoice approval.

- Multiple payment methods (ACH, virtual card, or check).

- Ensure compliance with tax and regulatory requirements.

- Gain real-time visibility into payment status and cash flow.

- Save up to 80% of time spent on manual payment processing.

- Gain real-time cash visibility across all payments.

- Reduce errors and mitigate fraud risk.

- Increase efficiency without expanding headcount.

Whether you’re processing hundreds or thousands of vendor invoices each month, automation can help you reduce costs, save time, and improve supplier satisfaction. Contact us to see how Vendor Payment Automation can streamline your AP workflows and deliver measurable ROI.