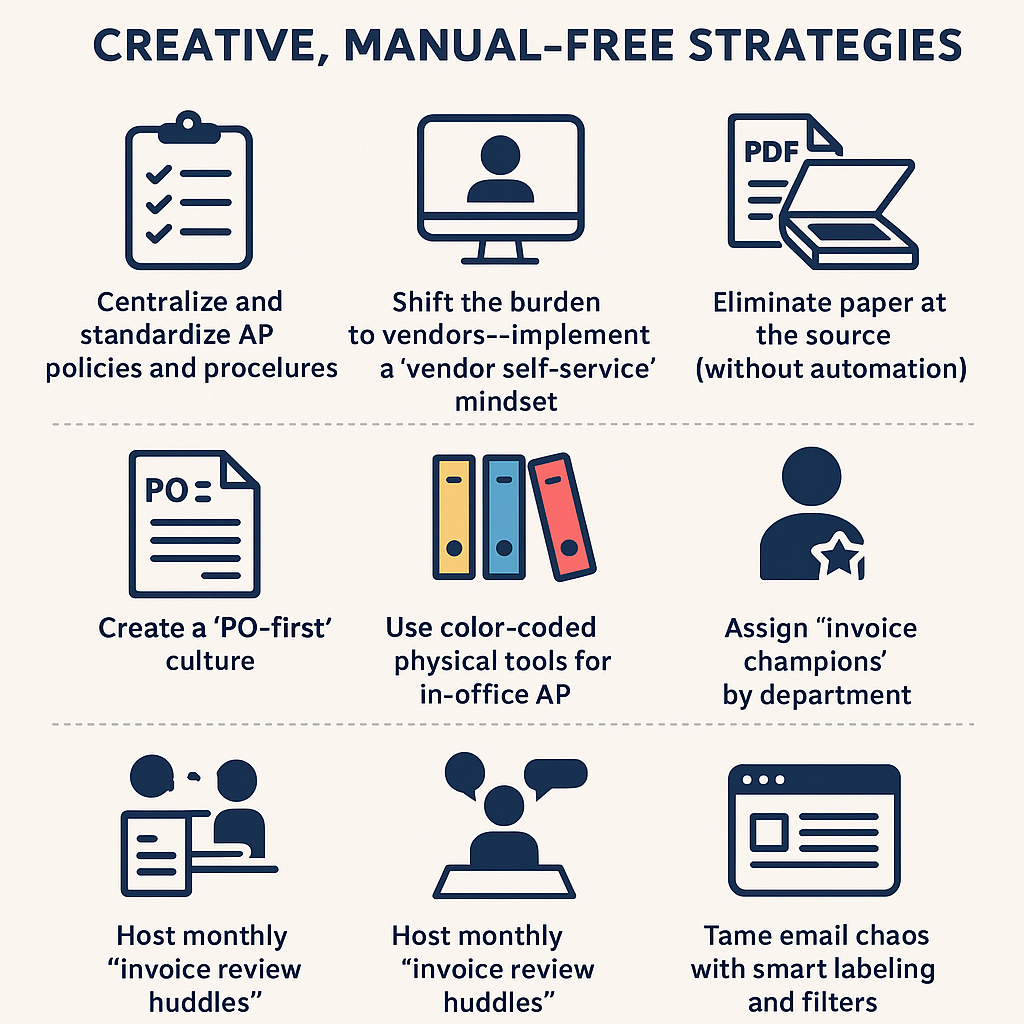

Streamlining Accounts Payable Without Automation

Creative, Manual-Free Strategies

In today’s hyper-efficient business landscape, automation often steals the spotlight when it comes to streamlining Accounts Payable (AP). But what if you're not ready for automation—or prefer to avoid the cost, complexity, or integration headaches that come with implementing an AP workflow system?

There are still plenty of non-automated ways to dramatically improve AP efficiency. Many of these methods are process-based, culture-driven, or leverage existing tools in creative ways. Below, we explore smart, often-overlooked strategies that reduce manual work without a single line of code or automation software.

1. Centralize and Standardize All AP Policies and Procedures

Why it matters: Inconsistent invoice handling is a key source of manual work.

What to do:

- Create a comprehensive AP manual with step-by-step instructions for handling invoices, approvals, disputes, vendor queries, and accruals.

- Ensure all stakeholders (AP clerks, department heads, vendors) are trained on these standards.

- Mandate standard formats for POs and invoices, with clearly defined required fields.

✅ Pro Tip: Use visual SOPs (standard operating procedures) and flowcharts to make procedures easier to follow—no software needed.

2. Shift the Burden to Vendors — Implement a “Vendor Self-Service” Mindset

Why it matters: Many AP inefficiencies stem from missing or incorrect vendor data.

What to do:

- Require vendors to submit invoices in a standardized format (e.g., PDF with PO in subject line).

- Mandate that vendors populate a standardized invoice cover sheet, downloadable from your website or included in onboarding kits.

- Set up a dedicated email address and strict submission guidelines to reduce email-based clutter.

✅ Out-of-the-box idea: Create a “Vendor Onboarding Kit” with instructions, sample invoice formats, W-9 forms, and FAQ. This shifts data entry and compliance upstream.

3. Eliminate Paper at the Source (Without Automation)

Why it matters: Paper introduces delays, errors, and storage headaches.

What to do:

- Close physical mailboxes for AP. Ask vendors to stop mailing invoices altogether.

- Use scanners and shared drives (like Google Drive or SharePoint) to store invoices.

- Ask internal stakeholders to submit invoice images from mobile phones when traveling or in the field.

✅ Out-of-the-box idea: Empower the front desk or mailroom to reject paper invoices on arrival and direct vendors to the proper digital channels.

4. Create a “PO-First” Culture

Why it matters: Non-PO invoices require more review and often bypass pre-approval processes.

What to do:

- Make POs mandatory for all purchases over a low threshold (e.g., $200).

- Publish a company-wide “No PO, No Pay” policy—and enforce it rigorously.

- Educate department heads and project managers on how and when to request POs.

✅ Bonus: Use Excel-based PO logs with pre-defined templates. No fancy software needed—just consistency.

5. Adopt Calendar-Driven Invoice Processing Cycles

Why it matters: Processing invoices on a rolling basis leads to chaos.

What to do:

- Establish weekly invoice intake days (e.g., Tuesday/Thursday only).

- Allocate specific days of the month for approvals, accruals, and vendor payments.

- Let vendors know your “invoice cut-off days” and stick to them.

✅ Out-of-the-box idea: Set up a shared team calendar (Google, Outlook) to visually track invoice cycles and deadlines.

6. Assign “Invoice Champions” by Department

Why it matters: Chasing down approvals and missing GL codes is a huge time sink.

What to do:

- Designate an Invoice Champion in every department who owns responsibility for coding and approving invoices.

- Provide them with GL code cheat sheets, training, and expectations around turnaround time.

- Use internal SLA (service level agreement) metrics to encourage fast action.

✅ Clever twist: Reward champions with shout-outs or small bonuses for timely approvals and clean submissions.

7. Use Color-Coded Physical Tools for In-Office AP

Why it matters: Visual systems reduce the need for constant verbal clarification.

What to do:

- Use colored folders, stamps, or bins to indicate invoice status: needs approval, ready to pay, disputed, etc.

- Place folders in designated locations by department or approver.

- Rotate colors monthly to track invoice age.

✅ Old-school, but effective: Implement a “red folder” system to immediately flag urgent invoices or disputes.

8. Build Smart Templates in Excel or Google Sheets

Why it matters: Manual entry errors eat time and cause payment delays.

What to do:

- Create pre-formatted invoice registers with dropdowns for GL codes, departments, and vendors.

- Use data validation and conditional formatting to highlight missing fields or errors.

- Maintain a vendor master file with up-to-date banking and contact info.

✅ Out-of-the-box idea: Use Google Forms to collect invoice data and auto-fill a spreadsheet for processing.

9. Host Monthly “Invoice Review Huddles”

Why it matters: One-time fixes don’t solve systemic inefficiencies.

What to do:

Hold short monthly meetings with AP, procurement, and department heads to review:

- Top 10 slowest invoices

- Recurring vendor issues

- Approval bottlenecks

Use these to adjust policies, retrain teams, or escalate chronic issues.

✅ Culture shift: Treat AP like a business partner, not a back-office task.

10. Tame Email Chaos with Smart Labeling and Filters

Why it matters: Invoices get lost in crowded inboxes.

What to do:

- Create inbox rules to label, sort, and auto-archive AP emails.

- Designate an AP triage person who checks email twice daily and logs incoming invoices to a master sheet.

- Avoid forwarding—stick to centralized viewing folders.

✅ Bonus: Use naming conventions like “INV_[Vendor]_[Date]” to make searching painless.

Final Thoughts

Automation isn’t the only path to AP efficiency. With a strategic mindset and creative thinking, AP departments can eliminate manual tasks, improve accuracy, and even elevate their internal reputation—all without investing in software. The real key is structure, discipline, and shifting effort to where it adds the most value: early in the process, not at the point of payment.

Executive Summary: Why ERP-Native AP Automation Fails — and Why Vision360 Enterprise Wins ERP “AP Automation” promises simplicity but delivers shallow workflow. Vision360 Enterprise was built from the ground up to automate the entire invoice lifecycle — from intelligent capture to payment — delivering true AI-powered efficiency, faster ROI, and freedom from ERP lock-in. 1. ERP Vendors Build Breadth, Not Depth ERP systems manage everything — but master nothing. Vision360 Enterprise focuses solely on AP automation , achieving: 2–3× higher straight-through processing Faster adoption and measurable time-to-value Continuous AI learning and enhancement 2. ERP “Automation” = Manual Workflows in Disguise ERP modules digitize invoices but still depend on manual validation, GL coding, and exception routing. Vision360 Enterprise applies automated business rules and logic to achieve near-touchless processing. 3. ERP Customization = Permanent Technical Debt ERP automation success requires heavy scripting and consulting — each upgrade breaks it again. Vision360 Enterprise integrates natively, updates seamlessly, and eliminates technical debt. 4. ERP Lock-In Limits Agility ERP automation binds you to one vendor and one process. Vision360 Enterprise connects across multiple ERPs, entities, and regions — providing agility through change. 5. Vision360 Enterprise Delivers Measurable ROI 70–80% fewer manual AP touches 50–60% faster invoice cycle times 2× early-payment discount capture Payback in under 12 months Conclusion: ERP vendors digitize invoices. Vision360 Enterprise automates intelligence. For finance leaders serious about eliminating manual work, improving visibility, and future-proofing their payables process — Vision360 Enterprise is the clear strategic choice.

Every month-end, accounting teams face the same challenge: closing the books quickly, accurately, and in compliance with reporting standards. But one recurring issue often slows things down — missing accruals. If you’ve ever been asked by accounting to “send your accruals,” it’s not just a formality. Your accruals are essential to producing an accurate picture of the company’s financial health. What Are Accruals? Accruals represent expenses that have been incurred but not yet invoiced or paid. They align costs to the correct accounting period — ensuring financial results accurately reflect when the work was done or the goods were received. Without accruals, one month’s profit may look inflated while the next month is overstated — skewing performance metrics, budgets, and forecasts. Why Accounting Needs Your Accruals 1. To Ensure Accurate Financial Reporting Accruals help accounting record expenses in the period they were incurred, not when invoices arrive. This ensures management and stakeholders see the company’s true financial position. 2. To Avoid Budget and Forecast Distortions When expenses are recognized late, they show up in the wrong month — confusing budget owners and making forecasts unreliable. Timely accruals keep budgets aligned and predictable. 3. To Accelerate the Month-End Close Every missing accrual adds hours or even days to the close process. Submitting accruals promptly helps accounting close faster, deliver timely reports, and support better business decisions. 4. To Maintain Compliance and Audit Readiness Auditors look for complete and consistent expense recognition. Well-documented accruals show adherence to GAAP or IFRS standards and demonstrate strong financial controls. 5. To Strengthen Collaboration Between Finance and Operations Submitting accurate accruals isn’t just helping accounting — it’s helping your entire business operate with transparency and precision. Best Practices for Submitting Accruals Track pending costs: Keep notes on goods or services received but not yet invoiced. Communicate early: Let accounting know about large or recurring expenses before month-end. Meet deadlines: Submit accrual details on time to support a smooth close process. Vision360 Enterprise: Using an AP Automation system like Vision360 Enterprise allows centralized processing of supplier invoices which allows accounts payable visibility and control with the ability to generate accruals instantaneously. The Bottom Line Accruals are more than a technical accounting task — they’re the foundation of financial accuracy. When every department participates in the accrual process, the result is faster closes, cleaner reports, and better business decisions. So next time accounting asks for your accruals, remember: they’re not chasing paperwork — they’re protecting accuracy, compliance, and the integrity of the numbers.

Be honest: Does your Accounts Payable process still rely on paper, email approvals, and manual data entry? If so, your AP process might be stuck in 1999 — while the rest of finance has moved decades ahead. In today’s fast-paced, AI-driven finance world, AP automation isn’t optional anymore — it’s essential. Here are five signs your Accounts Payable process needs automation, and how modern finance teams are transforming their workflows with AI-powered invoice processing and automated approval systems. 1. You’re Still Digging Through Emails or Paper Invoices If your team still receives invoices as PDFs, attachments, or even paper copies, you’re stuck in a pre-cloud era. Back in 1999, mail and fax were standard. But in 2025, manual invoice handling wastes time, increases data entry errors, and limits visibility. Modern AP automation systems use intelligent data capture, AI and OCR technology to automatically extract and validate invoice data — no typing, no spreadsheets, no missing files. Why it matters: Eliminates manual entry and human error Prevents lost or duplicate invoices Speeds up processing and approvals Modern alternative: A cloud-based invoice capture service that imports invoices automatically and syncs them directly with your ERP or accounting platform. 2. Approvals Still Depend on Email Threads or Paper Signatures If managers still approve invoices by replying to emails or signing paper copies, your invoice approval workflow hasn’t changed in 25 years. Today’s AP automation platforms use automated approval workflows that route invoices instantly based on predefined rules — by department, spend threshold, or GL code. Every action is tracked, timestamped, and auditable. Benefits of automation: Instant routing and escalation Full visibility for AP and management Clear audit trail and compliance record Modern alternative: Rules-based approval automation that eliminates delays, reduces bottlenecks, and ensures on-time payments. 3. You Have Little or No Real-Time Visibility Into Payables In 1999, waiting for end-of-month reports was normal. But in 2025, real-time visibility into payables is mission-critical for cash flow and forecasting. If you’re still updating spreadsheets or manually reconciling data, you’re missing the insights needed to manage spend effectively. Modern Accounts Payable automation dashboards show invoice statuses, exception alerts, and payment readiness in real time — no waiting, no guesswork. Why visibility matters: Prevents late payments and cash surprises Supports better decision-making Strengthens supplier relationships Modern alternative: A real-time AP analytics dashboard that delivers instant insight into outstanding invoices, payments, and workflow performance. 4. You’re Still Cutting Paper Checks or Logging Into Multiple Portals If your AP team still prints checks or logs into multiple banking portals to make payments, you’re wasting hours on tasks that modern payment automation systems can do in seconds. In 1999, that was standard. Today, automated payment processing securely matches invoices to purchase orders, schedules payments, and reconciles accounts automatically. Why automate payments? Reduces fees, errors, and fraud Improves supplier satisfaction Speeds up month-end close Modern alternative: End-to-end payment automation that manages ACH, virtual cards, and digital payments directly from your AP automation platform. 5. Your AP Team Is Overworked and Undervalued If your Accounts Payable team spends most of their time keying data, chasing approvals, and answering vendor questions, they’re working harder — not smarter. AI in Accounts Payable eliminates repetitive work, empowers staff, and shifts focus toward higher-value activities like supplier analysis and cash management. Benefits of AI-powered AP workflows: 70–80% fewer manual tasks Lower risk of data errors Happier, more productive teams Modern alternative: AI-driven AP automation software with intelligent routing, exception handling, and self-service supplier portals. The Bottom Line: 1999 Processes Can’t Compete in 2025 and Beyond. Finance has evolved. Paper-based, manual Accounts Payable processes haven’t. Modern AP automation solutions deliver speed, accuracy, and real-time visibility across the entire invoice-to-pay cycle. By embracing AI and automated workflows, you build a finance operation that’s smarter, faster, and future-proof. If your current AP workflow shows even one of these five signs, it’s time to automate — because 2025-ready finance teams don’t just process invoices, they analyze, optimize, and innovate. Next Steps: Modernize Your Accounts Payable with AI Audit your current AP workflow — find bottlenecks, delays, and data entry points. Calculate your manual processing cost — time, errors, and lost discounts add up. Explore AI-powered AP automation software that integrates with your ERP and provides full visibility. Don’t let your Accounts Payable team operate like it’s still 1999. Modernize with AI-driven AP automation to reduce costs, accelerate approvals, and empower your finance team. If you’re ready to see how AI-powered AP Automation can transform your finance operations, book a demo or schedule a workflow assessment . We’ll show you how to eliminate manual processes, reduce costs, and bring your Accounts Payable process into the modern era.